Mastering Market Dynamics: A Strategic Guide to Bull and Bear Markets

2024-03-20

Mastering Market Dynamics: A Strategic Guide to Bull and Bear Markets

Understanding the dynamics of bull and bear markets is essential for anyone venturing into the world of investing. These terms not only reflect market conditions but also capture the underlying investor sentiment that drives market movements. This guide will help you understand better how markets work by diving into the definitions, identifying markers of bull and bear markets, and introducing the nuances of market corrections and sideways trends.

Defining Bull and Bear Markets

Bull Markets: Characterized by a robust upward trajectory in market prices, bull markets signify a period of economic expansion, increased investor confidence, and widespread optimism within the financial community. These markets are generally identified by a 20% or more increase in market prices from recent lows.

Bear Markets: In contrast, bear markets are defined by a downturn, with market prices declining by 20% or more from recent highs, reflecting periods of economic contraction. Investors are usually cautious during this period.

Navigating the Signals: Identifying Market Trends

The ability to discern whether you're in a bull or bear market can significantly influence your investment strategy. Here are some useful tools to help you determine the market state:

- Technical Analysis: Employ technical indicators like the Relative Strength Index (RSI) and moving averages to discern market trends. Draw trend lines on indices charts to determine the direction of the market. A consistent upward trajectory in prices may signal a bull market, whereas a downward trend could indicate bearish conditions.

- Economic Indicators: GDP growth rates, unemployment data, and consumer confidence indexes are key metrics. Rising economic indicators typically align with bull markets, whereas declining figures are common in bear markets.

- Market Sentiment: The collective mood of investors can also guide trend identification. Enthusiasm and high trading volumes often reflect bull markets, while withdrawal and low volumes are bearish signals.

Beyond Bull and Bear: Understanding Dips, Corrections, and Sideways Markets

Dips: Dips are short-term declines in market prices (minor setbacks within larger bullish trends). These are often seen as buying opportunities for investors believing the overall upward trend will continue, hence the expression ‘buy the dip’.

Corrections: A correction occurs when there is a temporary reversal of at least 10% in the market prices from a recent peak. Unlike bear markets, corrections are shorter in duration and can happen within both bullish and bearish trends, often signaling a healthy adjustment.

Sideways (Flat) Markets: Characterized by little to no significant change in market prices, sideways markets can be seen as periods of consolidation. Here, the forces of supply and demand are in equilibrium, leading to a stable market awaiting new momentum.

Strategies for Bull and Bear Markets

Bull Market Strategies: Capitalize on rising markets by investing in high-growth sectors. However, remain vigilant for signs of overvaluation to mitigate the risk of subsequent downturns.

Bear Market Strategies: Focus on preservation with investments in safer, dividend-paying stocks, or consider fixed-income securities. Bear markets also offer the opportunity for buying undervalued securities poised for recovery.

Navigating Market Fluctuations with Confidence

Investing in bull and bear markets requires not just an understanding of these conditions but also a strategy that aligns with your financial goals and risk tolerance. Educating yourself on market indicators and maintaining a diversified portfolio can help you navigate these changing tides.

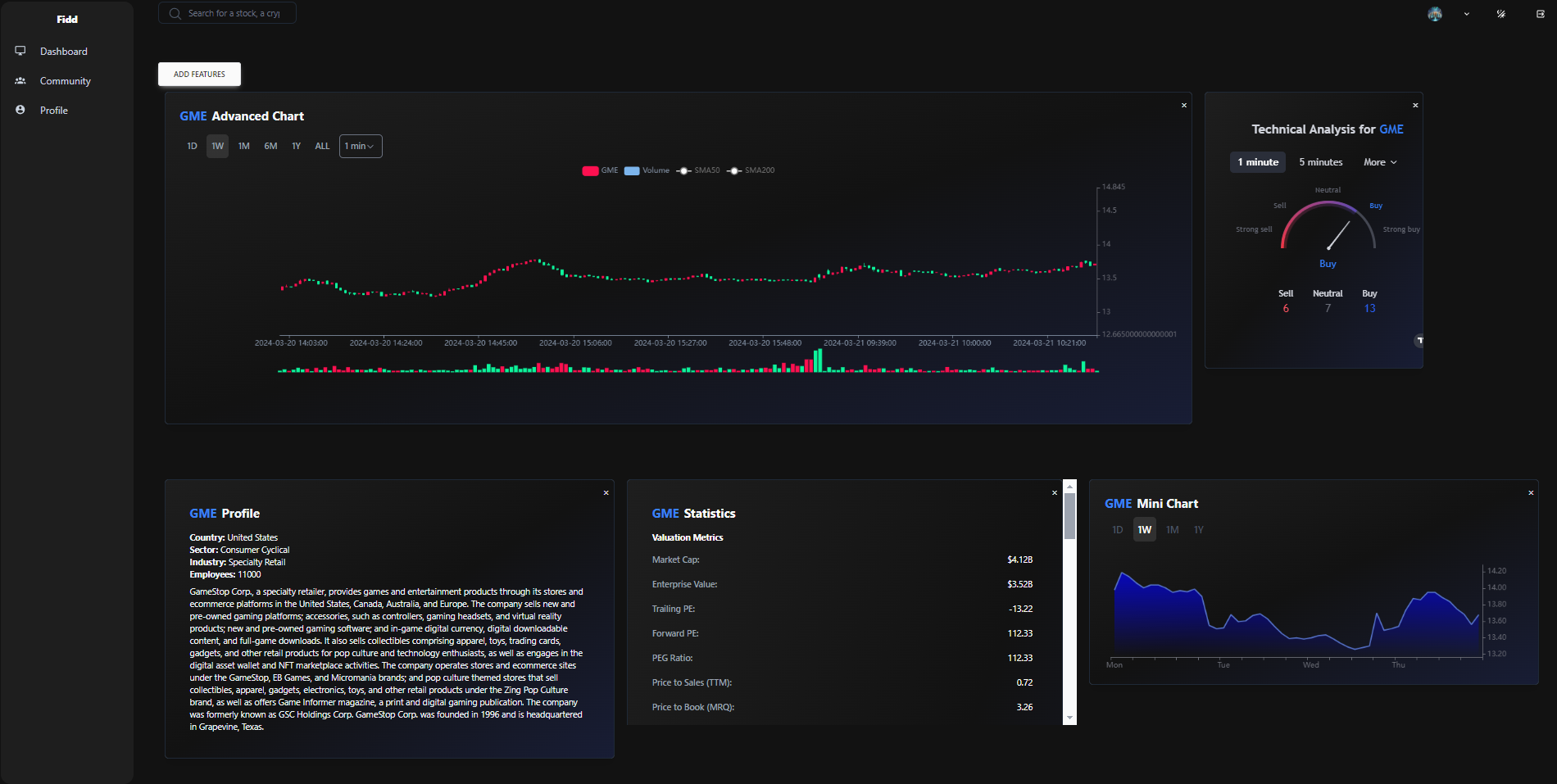

Using Fidd can help you make informed investment decisions. In today's digital age, having access to comprehensive financial analysis tools can significantly enhance your ability to adapt to both the opportunities and challenges presented by bull and bear markets.

Conclusion

Bull and bear markets are intrinsic to the investment landscape, each presenting unique challenges and opportunities. By understanding these market conditions and employing strategic approaches to investing, you can navigate the financial markets more effectively. Remember, informed decision-making and a well-considered investment strategy are your best tools for success in any market condition!

Join the Fidd community today and empower your investment journey with real-time insights, analytics, and a network of knowledgeable investors.